MARK REYNOLDS: GeoVax is currently in the strongest financial position the company has been in recent memory. In late September 2020, we closed a $12.8 million public offering, issuing a total of 2,310,000 units at a price to the public of $5.00 per unit consisting of one share of common stock and one five-year warrant to purchase one share of common stock at an exercise price of $5.00, and a total of 250,000 units issued at a price to the public of $4.99 per unit consisting of one pre-funded warrant to purchase one share of common stock at an exercise price of $0.01 and one five-year warrant to purchase one share of common stock at an exercise price of $5.00.

Importantly, this financing included no toxic provisions that plagued the company in past years. This was a clean financing and allowed the company to eliminate significant liabilities that have held GeoVax back in the past. Thanks to this financing, GeoVax exited the fourth quarter of 2020 with cash and equivalents of $9.9 million, a significant improvement in our financial position from the $0.3 million balance at year-end 2019. Importantly, we have positive working capital of $9.4 million, as compared to negative $1.6 million at the end of last year.

Subsequent to year-end, in February 2021, we raised an additional $9.4 million through an overnight offering that was priced at a premium to the September 2020 public offering, at $6.25 per share with no warrants issued. Also during the first few months of 2021, we've seen around 690,000 of the warrants that were issued in the September public offering exercised at $5.00 per share, providing another $3.2 million in proceeds. And so, as of late March 2021, GeoVax has current cash balances in excess of $20 million. This strong cash balance allows us to move forward with the accelerated development of our vaccine programs in 2021.

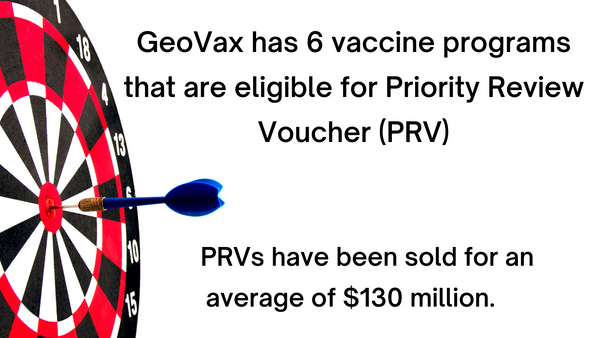

From a beyond 2022 perspective, I’m particularly excited about the possibilties for significant non-dilutive funding arising from the potential sale of Priority Review Vouchers (PRVs) that could be awarded to the company for any of our six qualifying vaccine programs. Of note, two PRVs were sold just recently in November 2020 by other pharmaceutical companies, one to AbbVie for $95 million and another to Argenx for $98 million. Of course, there can be no guarantee that GeoVax will be awarded PRVs on any of our candidates, but the upside potential value here is many multiples of our current valuation.

Finally, I’m proud of the job that the team has done to recapitalize the company. We have made tremendous progress as evidenced by our uplisting to NASDAQ at the end of September 2020. The team has worked tirelessly to right the ship and the listing on NASDAQ was an important achievement. GeoVax's officers and directors took significant salary and fee deferrals in order to help the company to conserve its cash resources and allow it to advance to where we are today. I’m proud of the commitment to the company that the Board and management have made and look forward to providing a further update on our next quarterly call.

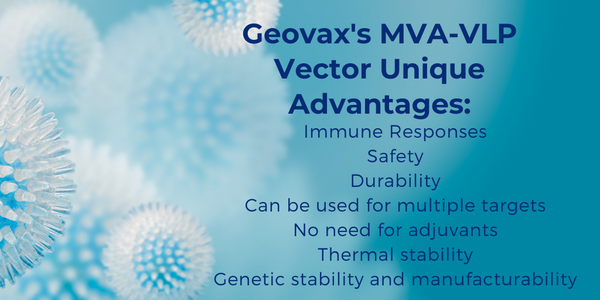

GeoVax Labs, Inc. is a clinical-stage biotechnology company developing human vaccines against infectious diseases and cancer using novel patented platforms. GeoVax’s Modified Vaccinia Ankara-Virus Like Particle (MVA-VLP) based vaccine platform utilizes MVA, a large virus capable of carrying several vaccine antigens, that expresses proteins that assemble into VLP immunogens in the person receiving the vaccine. The production of VLP in the person being vaccinated can mimic virus production in a natural infection, stimulating both the humoral and cellular arms of the immune system to recognize, prevent, and control the target infection. The MVA-VLP derived vaccines can elicit durable immune responses in the host similar to a live-attenuated virus, while providing the safety characteristics of a replication-defective vector.

GeoVax’s MVA-VLP development programs are focused on preventive vaccines against COVID-19, HIV, Zika Virus, and hemorrhagic fever viruses (Ebola, Sudan, Marburg, and Lassa), as well as therapeutic vaccines against multiple cancers. The Company has designed a preventive HIV vaccine candidate to fight against the subtype of HIV prevalent in the commercial markets of the Americas, Western Europe, Japan, and Australia; human clinical trials for this program are managed by the HIV Vaccine Trials Network (HVTN) with the support of the National Institutes of Health (NIH). GeoVax’s HIV vaccine is also part of a collaborative effort toward a functional cure for HIV.

Forward-Looking Statements

This release and the related conference call contain forward-looking statements regarding GeoVax’s business plans and financial results. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Actual results may differ materially from those included in these statements due to a variety of factors, including whether: GeoVax and its collaborators are able to complete their work within the expected timeframes, GeoVax is able to obtain the patent protection sought, GeoVax’s COVID-19 vaccines can provoke responses to multiple COVID-19 antigens, and those vaccines can be used effectively as a primary or booster to other COVID-19 vaccines, GeoVax’s viral vector technology adequately amplifies immune responses to cancer antigens, GeoVax can develop and manufacture its vaccines with the desired characteristics in a timely manner, GeoVax’s vaccines will be safe for human use, GeoVax’s vaccines will effectively prevent targeted infections in humans, GeoVax’s vaccines will receive regulatory approvals necessary to be licensed and marketed, GeoVax raises required capital to complete vaccine development, there is development of competitive products that may be more effective or easier to use than GeoVax’s products, GeoVax will be able to enter into favorable manufacturing and distribution agreements, the impact of the COVID-19 pandemic continues, and other factors, over which GeoVax has no control. Further information on our risk factors is contained in our registration statement on Form S-3 and the periodic reports on Form 10-Q and Form 10-K that we have filed and will file with the SEC. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Contact: GeoVax Labs, Inc. investor@geovax.com 678-384-7220

For more information, please visit www.geovax.com or follow us on Twitter at @Geovax_News and LinkedIn.